wv estate tax form

Afterwards you will be redirected to your County real estate database. 2020 2019 2018 2017 2016.

Tax Form Templates 5 Free Examples Fill Customize Download

Sign Online button or tick the preview image of the form.

. IT-141 TAX CREDIT RECAP SCHEDULE 2021 This form is used by individuals to summarize the tax credits that you may claim against your tax. The exemption equivalents are. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the transfer of assets from the deceased to.

Federal Estate Tax Return Form 706 for the estate of every citizen of the United States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent. Instructions include rate schedules. Wwwtaxwvgov File online at httpsmytaxeswvtaxgov P 0 9 0 9 1 8 0 1 W.

Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property. Prior to 2005 West Virginia like many other states did impose a state estate tax. STEp 3 COmpLETE NONprOBATE INVENTOry FOrm ET 602 IF rEquIrED.

Schedule F Form IT-140 Statement of Claimant to Refund Due Deceased Taxpayer. The exemption equivalents are. Property Tax Forms and Publications.

Change of Address Form Tax Levy Rates. A West Virginia small estate affidavit also known as a short form settlement is a form that can be used to hasten the distribution of an estate worth 50000 or less in the State of West Virginia. WVgov is the official Web site for the State of West Virginia and is the result of an innovative public-private partnership between the state and West Virginia Interactive.

Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall federal estate tax bill but when the federal tax law changed. 2023 Trend and Depreciation Trend and Percent Good Tables for Tax Year 2023. READ THESE INSTRUCTIONS FOR FILING FORM ET 601 AND FORM ET 602.

After the affidavit is filed with a local probate court the assets belonging to the estate can be distributed among successors. Step 1 Go to This Webpage. In addition to complet-ing this summary form each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed.

2016 Levy Rates. Both this summary form and the appropriate credit calculation schedules or forms. The advanced tools of the editor will guide you through the editable PDF template.

STEp 2 COmpLETE ApprAISEmENT FOrm ET 601. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of. Enter your official contact and identification details.

NRER Application for Early Refund of Withholding on Sales of Real Property by Nonresidents. Form 706 is used by the executor of a decedents estate to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. STEp 4 mAIL Or DELIVEr ThE FOrmS TO ThE prOpEr AuThOrITIES a more detailed look at these four steps begins on the next page.

For education related forms please see the Providers Instructors page. Online payments for all change filings and certificates of licensure are not available at. 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011.

To get started on the document utilize the Fill camp. Schedule A Form IT-140 Nonresidents Part-Year Residents Schedule of Income. The effect was to divert some of the federal estate tax to the state without increasing the estates overall tax bill.

2022 STC-1232-I Industrial Business Property Return. Farm Use Valuation If you have a tract of land that you primarily use for the sale use or consumption of. The tax was sometimes called a pick-up tax or sponge tax because it was equal to part of the total federal estate tax.

Year of death Exemption Equivalent 2004 through 2005 1500000 2006 through 2008 2000000 2009 3500000. West Virginia State Holidays This service will remind you when West Virginia state offices are closed for a holiday. 2014 Personal Property Return Online filing will be available beginning July 1st Business Personal Property Return.

NRSR Return of Income Tax Withholding for Nonresident Sale of Real Property. Year of Death Exemption Equivalent 2001 675000 2002 through 2003 1000000 2004 through 2005 1500000. WV Estate Appraisement and Nonprobate Inventory Forms and Instructions STEP 1.

2022 STC-1232-I Supplemental Filing Instructions for the Industrial Property Return. Typically you will be able to lookup a property by the Owners Name and Property Address. Box 342 Charleston WV 25322-0342 FOR ASSISTANCE CALL 304 558-3333 TOLL FREE 800 982-8297 For more information visit our web site at.

Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. Most states including West Virginia dont currently collect an estate tax. How you can complete the WV 2014-2019 form on the web.

This is a list of all forms for candidates licensees and complaints. Schedule FTC-1 Form IT-140 Family Tax Credit. You should read these introductory instructions completely before beginning any work on the forms.

2020 2019 2018 2017 2016 2015 2014. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. Step 2 After selecting your county you will want to access your County Assessor information by clicking the Go to Online Data link.

NRAE Application for Certificate of Full or Partial Exemption. Please ensure all fees and pertinent documentation is submitted when mailing them into the Commission. West Virginia Quarterly Estimated Tax Filing This service reminds you to file your quarterly estimated taxes with the West Virginia State Tax Office.

WEST VIRGINIA STATE TAX DEPARTMENT Tax Account Administration Div PO. Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent. IT-101Q Employers Quarterly Return of Income Tax Withheld - Form and Instructions IT-101V Employers West Virginia Income Tax Withheld IT-102-1 Affidavit of West Virginia Income Tax Withheld by Employer IT-103 Withholding Year End Reconciliation IT-104 West Virginia Employees Withholding Exemption Certificate.

WV Estate Appraisement and Nonprobate Inventory Forms and Instructions page 2.

Form 1040 X Now Can Be E Filed But Just For Now To Correct 2019 Return Mistakes Don T Mess With Taxes

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Understanding The 1065 Form Scalefactor

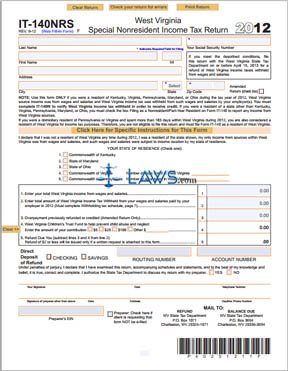

Free Form It 140 Nrs Special Non Resident Income Tax Return Free Legal Forms Laws Com

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

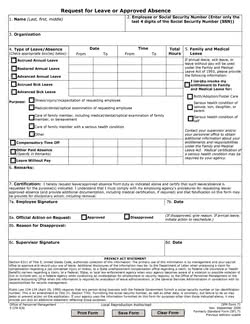

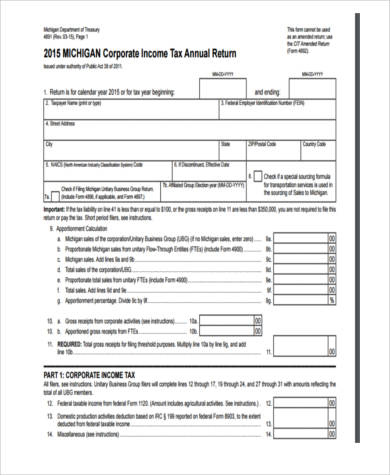

Free 9 Sample Printable Tax Forms In Ms Word Pdf

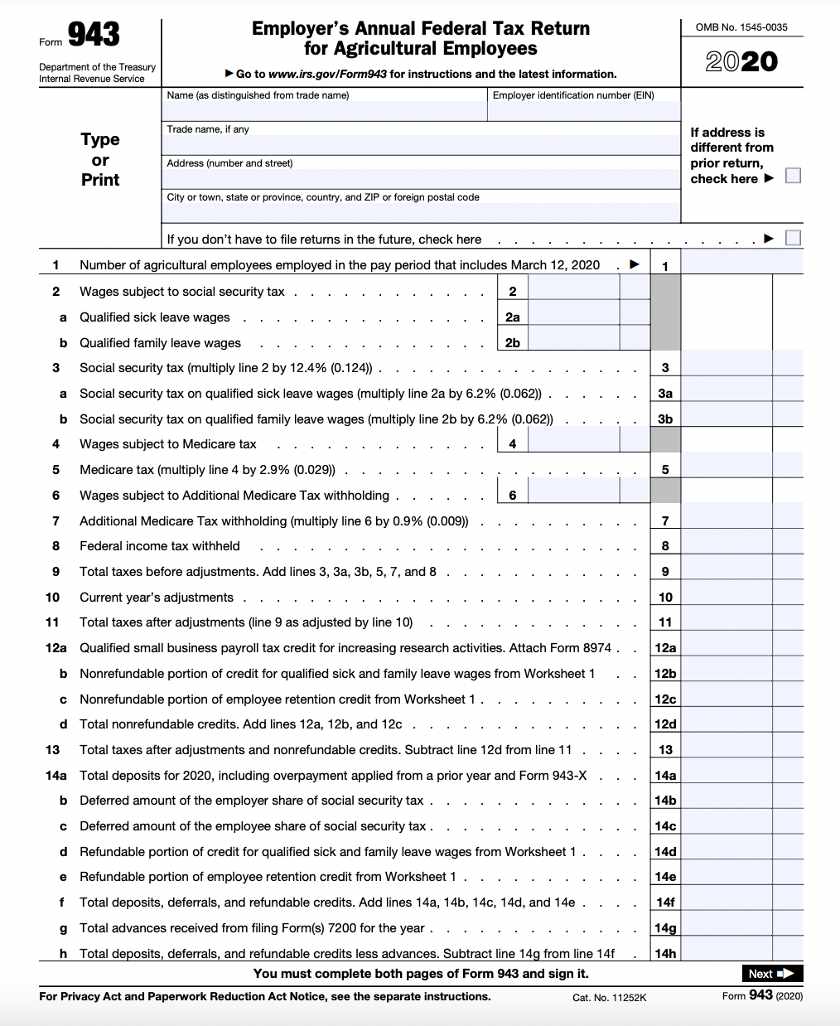

How To Fill Out Form 943 Step By Step Instructions Mailing Addresses

Tax Form Templates 5 Free Examples Fill Customize Download

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

Tax Form Templates 5 Free Examples Fill Customize Download

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

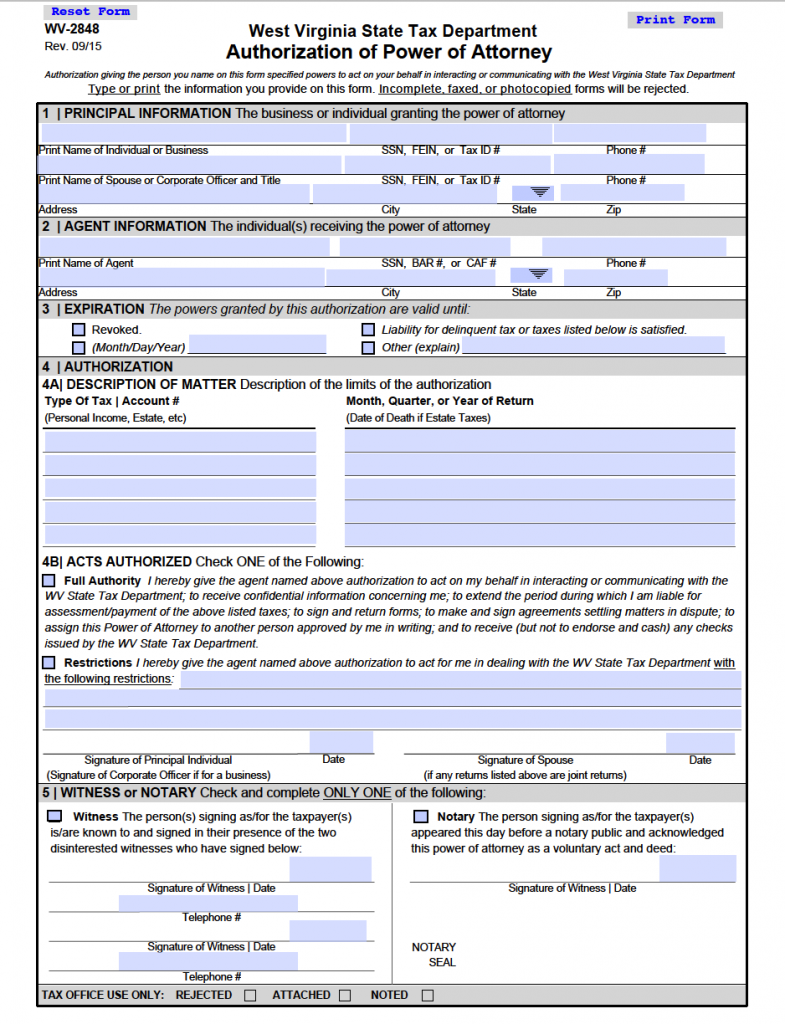

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

Ky Tangible Property Tax Return 2021 Fill And Sign Printable Template Online Us Legal Forms

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca